Content

For example, if a company had fixed costs of $10K and produced 10K items, then each item would be assigned $1 fixed costs. Gross profit is the difference between sales revenue and cost of goods sold. On the other hand, net profit is the final profit after all expenses and incomes of the business are accounted for. COGS mainly includes variable costs, which consist of the direct labor or wages for production workers, direct materials, utilities for production facilities, and freight-in costs. Manually preparing expense reports, income statements, and cash flow statements can be time-consuming.

To calculate gross profit, subtract the cost of goods sold from the sales revenue. When the value of COGS increases, the gross profit value decreases, so you have less money to deal with your operating expenses. It does not include fixed costs, which are expenses that do not change based on production levels.

What Is Gross Income?

The tools and resources you need to take your business to the next level. The tools and resources you need to get your new business idea off the ground. Multimedia Hub Browse podcasts, videos, data, interactive resources, and free tools.

It typically includes direct material cost, direct labor cost, and direct factory overhead. Automating your financial analysis helps you save time and gives you access to real-time data whenever you need it. Not to mention, automation also reduces the errors that occur when you prepare reports by hand, so you can feel confident you’re making decisions based on the most accurate information. Before you grow your net profit margins, you need to have a baseline of your current profits and a method for consistently measuring them. Similarly, total expenses account for all your company’s expenses — whether product-related or administrative. Net profit is also referred to as your company’s bottom line since it’s the last line on your income statement.

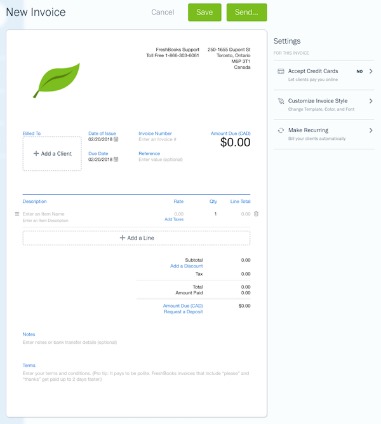

Free Invoice Templates – Small Business

Investors and owners can get the insight they seek about a business’s profitability. The gross profit formula is used to calculate the gross profit by subtracting the cost of goods sold from revenue. Revenue equals the total sales, and the cost of goods sold includes all of the costs needed to make the product you’re selling. Gross Profit is the income a business has left after paying all their variable costs directly related to the manufacturing of their products and/or services . Net Profit is the income a business has left after deducting all of their expenses from a company’s revenue—including the fixed costs that are excluded from Gross Profit . Cost of goods sold, or “cost of sales,” is an expense incurred directly by creating a product.

What is the difference between net and gross?

Gross pay is what employees earn before taxes, benefits and other payroll deductions are withheld from their wages. The amount remaining after all withholdings are accounted for is net pay or take-home pay.

Gross profit is calculated by subtracting the cost of goods sold from total revenue. Gross profit includes the costs of selling the item such as delivery charges to ship to the customer and any sales commissions. It also includes the cost of getting the items from the supplier to you, such as delivery (‘carriage’ in accounting terms) and any modifications that you make to it before sale.

How Do You Calculate Gross Profit Margin?

Business expenses are costs incurred in the ordinary course of business. Business expenses are tax-deductible and are always netted against business income. Net income is far more helpful in determining the financial position of a business. But even net income is limited in that it is only useful for evaluating one company’s performance from year to year. For example, companies often invest their cash in short-term investments, which is considered a form of income.

You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money. Allocate the factory overhead cost pool to cost objects (i.e., produced goods).

Overall, the gross profit percentage is still a great financial tool for getting a snapshot of a company or property’s performance. It’s also important to look at a company’s gross profit percentages over time to evaluate common financial trends and prospective growth down the line. As always, it’s important to understand how the gross profit ratio formula works, and what its variables mean.

- See more of her work and learn more about her services at deannadebara.com.

- A $3 million gross profit from $10 million of revenue equates to a 30% gross margin.

- These articles and related content is not a substitute for the guidance of a lawyer , tax, or compliance professional.

- Business expenses are costs incurred in the ordinary course of business.

- Gross profit for service sector companies, such as law offices, with no COGS, is typically equal to its revenue.

- It also gives you a look at how efficiently you manage overhead costs.

Gross profit helps investors determine how much profit a company earns from producing and selling its goods and services. To find the gross profit, you need to understand what revenue and cost of goods sold are. The calculation for cost of goods soldincludes the expenses directly related to producing your products or services (e.g., https://quick-bookkeeping.net/invoice-templates-for-word-and-excel/ raw materials). A company determines its gross profit margin by dividing gross profit by net sales revenue and expressing the result as a percentage. While gross profit measures how much cash is left over from product sales after accounting for cost of goods sold, gross profit margin measures how profitable those products are.

Tax Authorities

Gross profit is different from net income, also known as net profit. They have different calculations and have entirely different purposes for determining how a Gross Profit Definition company is doing. Your business’ net profit tells you if you’ve actually achieved profit. It also gives you a look at how efficiently you manage overhead costs.

Net income is an important metric that investors use to assess a company’s profitability and growth potential. If a company does not have a positive net income, investors may not be interested. On the other hand, gross profit is dictated by net revenue and cost of goods sold . Gross profit is different from net profit, also referred to as net income.